[ad_1]

What’s leading of intellect for authentic estate fiscal leadership

As part of her organized remarks to the National Association for Enterprise Economics (NABE), United States Treasury Secretary Janet Yellen recently proposed that the U.S. govt should really fortify its banking policies, or at the very least enforce them extra totally on extra financial institutions. In associated remarks at a modern push conference, Federal Reserve Chair Jerome Powell likewise indicated the board was evaluating the ideal policies to place in area, so that it does not take place once more, then implementing individuals guidelines.

Meanwhile, entrepreneur and trader Mark Cuban shared his gut reaction on his Twitter account and in subsequent interviews, suggesting that opening quite a few more accounts for his providers as a measure to insure much more resources under the Federal Deposit Insurance policy Corporation (FDIC) restrict. This didn’t account for the tag-on accounting demands of greater bank reconciliations, included treasury oversight, layers of inner controls and in general further overhead essential. Cuban later famous the target of included coverage, irrespective of the place it will come from, will incorporate affiliated rates that are acceptable and important.

To adapt to these improvements, finance features want to revise their treasury administration methods and procedures, and that could include:

- Revising expense guidelines.

- Implementing new income administration equipment.

- Renegotiating banking associations to make sure adequate obtain to credit rating and other products and services.

With the highlighted threats to our banking institutions, management and finance capabilities should really be aware of the dangers affiliated with getting rid of strains of credit history they had planned to use for usual functions or strategic plans.

Additionally, derivatives, these kinds of as amount caps and swaps, have improved counterparty possibility. As a end result, businesses must get the job done closely with their financial institutions and other company providers to examine their chance publicity while they enhance their treasury operations.

What true estate leaders are discussing

Today’s serious estate business leaders are uncovered to swiftly altering situations linked to leases, occupancy premiums and improved lending constraints. Looking for to validate these insights, BPM just lately convened a panel of true estate CFOs to highlight what executives are looking at in this important sector. Similar evaluation and commentary are supplied in the conversations that observe.

Please take note that the adhering to anonymized panel remarks have been edited for size and clarity.

Treasury management adjustments

The genuine estate panel’s treasury management conversations discovered a essential takeaway: Treasurers ought to stay up to day on the most recent developments in the banking market and economic marketplaces, and they must do the job carefully with their banking companies and other assistance companies to handle pitfalls and improve their treasury functions. Supplemental commentary centered on the subsequent:

- “We did not want to be the 1 that ran on the bank, so I was trying to go promptly to make certain FDIC coverage at my financial institution. Inevitably we essential to start off some new relationships.”

- “Moving revenue can be tricky with various entities. You can get into a real mess by co-mingling funds… typically not agreeable with our running agreements.”

- “It will be a lot more tricky to negotiate with our banking institutions as they are further squeezed but also as ‘too significant to fall short banks’ achieve more electric power.”

Emerging developments in true estate finance

In reaction to continued tightening in lending standards, financial commitment methods in industrial business serious estate finance are evolving. 1 pattern is the rise of non-regular loan providers, such as personal equity firms and hedge resources, who are significantly investing in industrial office environment houses through “debt money,” but with a low-danger tolerance that sales opportunities to a minimal personal loan-to-worth (LTV) ratio. Added development analysis commentary targeted on the next:

- “The trouble with ‘debt funds’ is they have to demand these kinds of exorbitant interest rates to make sense in this marketplace. It looks that they do not want to get on that hazard profile in their fund now thanks to uncertainties concerning in which the costs are going.”

- “Is anybody making use of Normal Spouse Money Lines? We are seeing costs rachet up a lot – Primary moreover 150bp is what to assume.”

Cash markets and investor relations

The group observed there is expanding fascination in environmental, social and governance (ESG) investing, which seeks to align monetary returns with optimistic social and environmental outcomes – particularly in the Euro and pension fund investor communities. More ESG-connected assessments integrated:

- “Making strides ahead in your providers is critical.”

- “Start to put in plans and rejoice what you are now accomplishing nicely.”

- “This will turn into a comprehensive-on ESG Application at some position quickly – specially in the more substantial actual estate businesses.”

Other observations highlighted skyrocketing insurance coverage expenses, with a 50% increase in earthquake protection mentioned by a person attendee and an instance of 1 nonprofit declining fireplace coverage somewhat than encounter an astronomical high quality.

The financial crystal ball

Environment apart possibility management and mitigation trends, the panel customers shared the pursuing observations and forecasts about fascination charge and credit rating threat areas:

- “Economists are forecasting just one, probably two far more price improves of 25 basis points, then the recession will start by the end of this year or get started early subsequent year….”

- “…Then, the Fed will aggressively go 275 foundation points down at that level subsequent 12 months to stabilize…”

- “…This is a frustrating forecast simply because it can make individuals sit on their palms.”

Place of work personal debt

There was a sense that return-to-workplace momentum could be “too late” for some landlords. For example, the latest San Francisco Bay Place media protection indicated some eye-opening return-to-office environment developments among polled regional companies, such as the subsequent:

- 23% of businesses approximate in-office environment employee attendance to be 3 days for each week.

- A smaller sized quantity, 19%, are functioning with worker attendance fully on premises.

- Probably a lot more challenging for industrial landlords, 21% of businesses are operating on a completely remote product. Further more, in-workplace employee existence is believed at one particular or two times for each week by 26% of businesses.

Linked panel discussion concerning office environment financial debt targeted on the following:

- “The Feds are seeing banks so closely, specially following the past couple of weeks.”

- “A senior banker I know is likely by an Business office of the Comptroller of the Currency (OCC) test now, and they are being questioned new and super-specific inquiries on their portfolio, in particular as it relates to threat rating.”

- “I suspect a variety of office environment buildings are becoming downgraded (akin to mark to sector internally), so resulting in margin phone calls if there are ongoing covenants, but definitely when it arrives time to refinance.”

“Uh, I’m just gonna’ quit likely.” – Peter Gibbons, Office environment Area (1999), on his intention to simply cease likely into the business office.

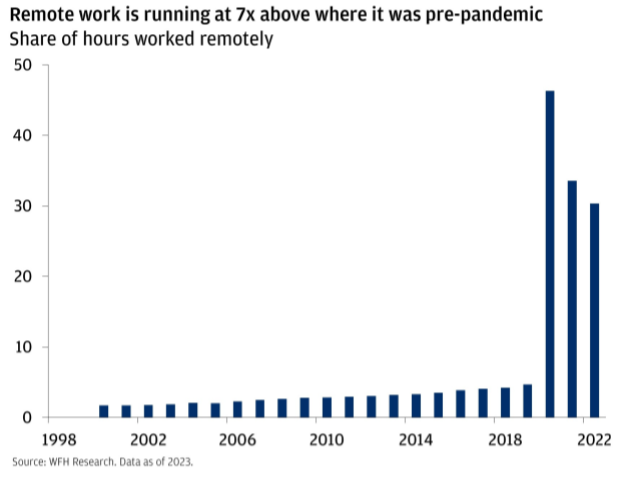

The moment relegated to the likes of the cult comedy motion picture Business Area, WFH Investigation demonstrates quite a few staff members have just stopped physically exhibiting up at the place of work.

With less staff members heading to do the job in person, enterprises appear to be a lot less inclined to lease as a great deal place of work area. Vacancies in U.S. workplace authentic estate have risen in current decades, and presently sit about 12.5%, which is equivalent to amounts noticed in the wake of the 2007-2008 World Financial Crisis.

Mix less desire with the prospects for much more pricey financing in today’s elevated curiosity rate environment, and the outlook for the office environment sector is challenged.

Way too considerably to borrow

Today’s fascination charges are at close to-decade highs, producing the expense of borrowing extra pricey than it’s been in a very long though. Most actual estate is financed by credit card debt, and in a space like professional real estate – where by houses are likely to be leased out – the cost of servicing that credit card debt is offset by operating income. As outlined in advance of, desire for place of work area, in individual, would seem to be waning, and larger interest rates mean an elevated price of carrying these structures. Jointly, these dynamics conspire to erode the price of the residence.

The stress? Assets proprietors or supervisors could determine that the economics of holding on to buildings doesn’t make perception anymore (or is unfeasible). The lenders who manufactured the loans to finance the attributes in the initial location could be left keeping the bag.

But creditors could not be so inclined to consider the keys to the creating again from the borrower – it is not just easy to work, allow on your own liquidate, a huge building on a metropolis block. Instead of foreclosing, we consider it’s very likely that loan companies and borrowers will occur to the table to agree on personal loan extension selections, discounted payoff ideas or other indicates of restructuring their agreements.

BPM summary direction

Actual estate CFOs have to have to be well prepared to adapt their treasury management techniques and processes to handle threats and make sure satisfactory obtain to credit and other services. By carrying out so, they can reduce the affect of any potential banking collapses or disruptions to their functions.

Be nimble in your technique to discussions with financial institutions about lending requirements and procedures for navigating interest price fluctuations. As the sector finds an equilibrium, these with the ideal toolbox will see quite a few much more opportunities.

References:

Yellen claims US bank regulations may perhaps be too free, need to have to be re-examined

Silicon Valley Financial institution leaders “failed poorly,” Fed Chair Jerome Powell claims

‘It’s Not the Wealthy Having the Hit’: Mark Cuban’s ‘Baby’ Between Businesses With Hundreds of thousands In Silicon Valley Bank

[ad_2]

Resource connection